China market slump: Central bank cuts interest rates

By BBC News

China has cut its main interest rate to boost growth in its economy.

The People's Bank of China cut its main interest rate by 0.25 percentage points to 4.6% in an effort to calm stock markets after two days of turmoil.It is the fifth interest rate cut since November and will take effect on Wednesday.

The move has boosted global share prices further, with Wall Street's Dow Jones index opening more than 1.7% higher after the move.

In mid-afternoon European trading, London's FTSE 100 was up almost 3%, while Germany's Dax and the Paris Cac were ahead nearly 5%.

Other European markets, including Lisbon, Madrid, Moscow and Milan, were all sharply higher.

Follow our live coverage of global markets.

The People's Bank said that the interest rate cut was to reduce "the social cost of financing to promote and support the sustainable and healthy developments of the real economy".

It also acted to increase the flow of money in the economy by cutting the amount of cash banks must keep in reserve, effectively freeing them to lend more cash.

The central bank's move was broadly welcomed by economists.

A research note from JP Morgan stated: "China's decision to cut... will be regarded by many investors as overdue. The litmus test will come overnight, however, and the efficacy of the... cut in boosting the domestic stock market."

Singapore-based investor Jim Rogers said he thought the panic over the Chinese market would be over soon: "I haven't sold any Chinese shares a couple of days ago, when they really collapsed, I bought more. Of course I'm losing money now on those. That kind of panic selling usually means the bottom is coming and I would suspect before too much longer the bottom will be in place."

Growth fears

The Chinese authorities have taken a number of steps to help stem stock market losses since the market began a series of heavy falls in June.Earlier, China's falling stock market had hit markets around the globe on Monday, and - although Asian markets were again hit overnight - European stocks had already opened in a more optimistic mood on Tuesday.

The global sell-off has been driven by fears that China's slowing growth means less business for everyone else.

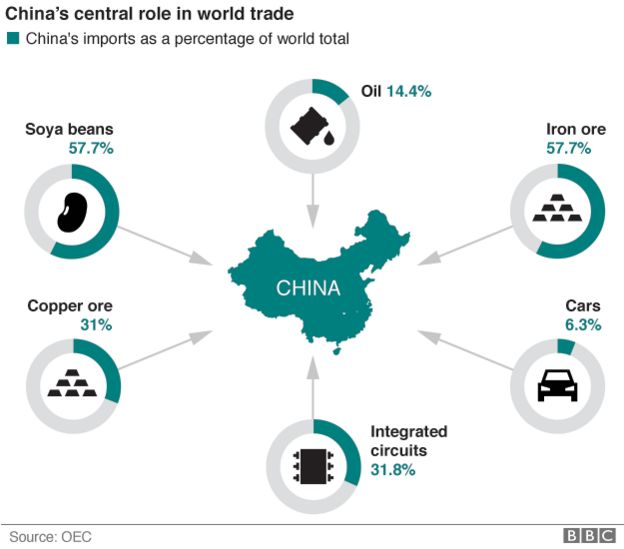

China's booming economy of the last 30 years has seen the country suck in supplies of raw materials for manufacturing and, increasingly, manufactured and luxury goods from other countries.

Analysis: Robert Peston, BBC business editor

Beijing will be hard pressed to meet its target of 7% GDP growth this year without doing the opposite of what is needed to put the economy on a sustainable footing, which is to curb debt-fuelled investment in infrastructure, construction and lame-duck heavy industries.Also very difficult to gauge is the scale of the negative impact on the spending habits of investors whose wealth has been mullered and on the investing habits of companies whose share prices have been poleaxed.

But there is a serious risk of economic aftershocks from the market quake: multinationals with production in China aimed at Chinese consumers tell me they are significantly scaling back their manufacturing plans.

The big point about today's Chinese monetary stimulus is that it may revive growth and the stock market in the short term - but it will further inflate China's dangerous debt bubble and will increase the longer term risk of a crash.

After decades of rapid growth, China is running out of steam. Investors globally are worried that firms and countries that rely on high demand from China - the world's second-largest economy and the second-largest importer of both goods and commercial services - will be affected.

But although the slowdown in the Chinese economy will have a bearing on Chinese firms' profitability, many view the stock market as grossly inflated.

The main Shanghai index more than doubled in the 12 months up to mid-June.

Weak manufacturing figures from China prompted a massive fall in shares on Friday, which was followed by another, the biggest in eight years on Monday, triggering a mass sell-off across the globe.

Although very few Chinese people own shares - only about 2% of the population - they are extremely active on its stock market. They are responsible for the majority of daily turnover and the government is trying to ameliorate the impact of the trading rout on those individuals.

Many bought shares with borrowed money, and as those investments fall in value, they are now selling them to pay back their debts.

The interest rate cut should make their debt levels a little more bearable.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home